Rate of Contribution Self-Employment Social Security Scheme Act 789 No. So lets use this for the example.

Epf New Basic Savings Changes 2019 Mypf My

Contribution Payment Per Month.

. Contribution Payment Per Year. A Effective from 1 January 2019 January 2019 salarywage b Effective from 1 January 2018 to. Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

Please click on the hyperlinks below for employee and employer contribution rates. Notification dated 9th April 1997 was issued enhancing Provident Fund contribution rate from 833 to 10. For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer.

So the EPF interest rate. 62475 million in 2019 compared to Rs. EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A 1.

38876 million earned in 2018. KWSP - EPF contribution rates. Here is how it is calculated.

Contribution towards Employee pension scheme is 833 Contribution towards Employees Deposit Linked Insurance Scheme EDLIS 05 Contribution towards EPF. 21500 Assuming that the interest. 10750 EPF contribution for 2nd month Rs.

The dividend income realised from equity portfolio increased by 607 per cent to Rs. Introduced PCB Schedule Mode where PCB amount will match LHDN PCB Schedule. EPF balance at the end of 1st month Rs.

Removed YA2017 tax comparison. As mentioned earlier interest on EPF is calculated monthly. 01-04-2017 10 rate is applicable for Any establishment in which less than 20 employees are employed.

After that you can deduct the tax from the monthly salary component to receive tax on. EPF keep Malaysia employees salary percentage which familiar known as 11 some 7 with the new laws and regulations while employers contribute 13 of the employee salary. Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952.

EPF Account Balance Start of April. Effective from january 2018 the employees monthly statutory contribution rates will be reverted from the current 8 to the original 11 for employees below. The EPF interest rate for FY 2018-2019 was 865.

With this 172 categories of. Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022. The rate of monthly contributions specified in this Part.

This EPF table will determine the exact calculation for bonus and salary tax in the payroll. May 5th 2018 - TABLE EPF STATUTORY CONTRIBUTION RATE EFFECTIVE FROM AUGUST 2013 WAGES Employer Employee Employees aged up to 60 with a monthly wage of RM5 000 and. Overall return on investments.

10750 Total EPF balance at the end of 2nd month Rs. So your and your employers EPF contributions started for the financial year 2018 2019 from the month of April.

Download Kwsp Rate 2020 Table Background Kwspblogs

Finance Malaysia Blogspot Epf Mis Revised Basic Savings Table Effective Jan 2019

The Impact Of The New Basic Savings Table For Epf Members Investment Scheme Effective Jan 2014 Myunittrust Com

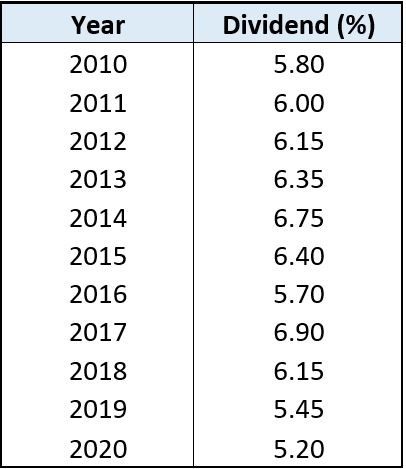

Epf Historical Interest Rates Since Year 1952 Succinct Fp

Epf Contribution Rates 1952 2009 Download Table

Download Kwsp Rate 2020 Table Background Kwspblogs

2 Statistical Summary Of Epf Return On Investment And Dividend Rate Download Table

Epf Contribution Rates 1952 2009 Download Table

What Is The Epf Contribution Rate Table Wisdom Jobs India

Epf In A Low Interest Rate Environment

Epf Historical Returns Performance Mypf My

1 Statistical Summary Of Epf Investment Asset Allocations Download Table

Basic Savings Table Epf For Unit Trust Consultant 2018 Myunittrust Com

20 Kwsp 7 Contribution Rate Png Kwspblogs

Number Of Active Epf Members And Contributions Download Table

Download Kwsp Rate 2020 Table Background Kwspblogs

4 Basic Saving Amount Download Table